Savvy Shopping for Those with Bad Credit: Your Ultimate Catalogue Companion is a guide designed to help individuals with low credit scores make smart purchasing decisions. For many people, having bad credit can make traditional shopping experiences challenging, as they may be denied credit or charged higher interest rates. However, with the right tools and knowledge, it is still possible to shop responsibly and improve your financial situation.

One of the unique features of this catalogue companion is its focus on catalog shopping, which can be a great option for those with bad credit. Catalog shopping allows individuals to make purchases on credit and pay over time without the need for a credit check. This can be a valuable resource for those looking to rebuild their credit or make essential purchases without the fear of rejection. In the next section, we will explore some key takeaways from this guide, including tips for smart catalog shopping and strategies for improving your credit score.

key Takeaways

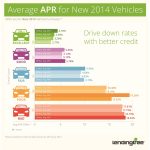

1. It’s important to be mindful of interest rates when using catalogs for shopping with bad credit, as they can be higher than traditional credit cards.

2. Make sure to prioritize paying off your balance in full each month to avoid accumulating more debt and improving your credit score over time.

3. Utilize catalogs to shop for essential items like clothing and household goods, but avoid unnecessary purchases that can lead to financial strain.

4. Take advantage of special financing and payment plans offered by catalogs to make your purchases more manageable and affordable.

5. Regularly review your credit report and communicate with catalog companies to ensure accurate reporting and address any issues that may arise.

How Can You Make the Most of Savvy Shopping for Those with Bad Credit: Your Ultimate Catalogue Companion?

Understanding Your Credit Situation

When shopping with bad credit, it’s important to have a clear understanding of your current credit situation. Take the time to review your credit report, identify any areas for improvement, and make a plan to address them.

Choosing the Right Catalogue Companion

Selecting the right catalogue companion can make a big difference in your shopping experience. Consider factors such as interest rates, fees, and available credit limits when choosing a catalogue to shop with.

Using Credit Responsibly

While shopping with a catalogue can be a convenient way to make purchases, it’s crucial to use credit responsibly. Make sure to only charge what you can afford to pay off each month to avoid accumulating debt and damaging your credit score further.

Maximizing Rewards and Discounts

Take advantage of any rewards programs or discounts offered by your catalogue companion to save money on your purchases. Look for special promotions, coupon codes, and cashback offers to stretch your shopping budget further.

Monitoring Your Spending

To stay on track with your budget and avoid overspending, regularly monitor your shopping habits and track your purchases. This will help you stay within your financial limits and prevent any surprises when the bill arrives.

Tip #1: Set a Shopping Budget and Stick to It

Setting a budget for your catalogue shopping can help you avoid overspending and accumulating unnecessary debt. Be realistic about what you can afford to spend each month and prioritize your purchases accordingly.

Tip #2: Pay Your Balances in Full Each Month

To avoid high-interest charges and potential damage to your credit score, make it a habit to pay off your catalogue balances in full each month. This will help you maintain a healthy financial outlook and avoid falling into a cycle of debt.

Tip #3: Take Advantage of Interest-Free Financing Options

Look for catalogue companions that offer interest-free financing options on purchases. This can help you spread out the cost of larger items over time without incurring additional fees or interest charges.

Tip #4: Shop Smart and Compare Prices

Before making a purchase with your catalogue companion, take the time to shop around and compare prices. Look for deals, discounts, and sales to ensure you’re getting the best value for your money.

Frequently Asked Questions

Can I still shop online with bad credit?

Yes, you can still shop online even if you have bad credit. Many catalogues and online retailers offer options for people with less than perfect credit scores.

How do I find catalogues that cater to those with bad credit?

You can start by doing a simple online search for catalogues that specialize in serving those with bad credit. You can also look for recommendations from others who have been in a similar situation.

Are there any additional fees or costs associated with shopping from catalogues with bad credit?

Some catalogues may charge higher interest rates or fees for customers with bad credit. It’s crucial to read the terms and conditions carefully before making any purchases to understand any associated costs.

What are some tips for improving my credit score while shopping from catalogues?

One tip is to make on-time payments on your catalog purchases, as this can help improve your credit score over time. You can also work on paying down any existing debts to further boost your credit score.

Can shopping from catalogues with bad credit affect my credit score?

Shopping from catalogues with bad credit can potentially affect your credit score if you do not make timely payments on your purchases. It’s important to stay on top of your payments to avoid any negative impact on your credit score.

Are there any benefits to shopping from catalogues with bad credit?

Shopping from catalogues with bad credit can help you rebuild your credit score by making on-time payments on your purchases. It can also provide you with access to products you may not be able to purchase elsewhere.

What should I look for when choosing a catalogue companion for bad credit shopping?

When choosing a catalogue companion for bad credit shopping, look for one that offers reasonable interest rates, flexible payment options, and a wide variety of products to choose from.

How can I ensure the security of my personal and financial information while shopping online with bad credit?

To protect your personal and financial information while shopping online with bad credit, make sure to only shop from secure and reputable websites. Avoid clicking on suspicious links and always use secure payment methods.

Can I return items purchased from catalogues with bad credit?

Most catalogues that cater to those with bad credit have return policies in place that allow you to return items within a certain timeframe. Make sure to familiarize yourself with the return policy of the catalogue before making any purchases.

How can I make the most out of my shopping experience with a catalogue companion for bad credit?

To make the most out of your shopping experience with a catalogue companion for bad credit, take advantage of any special offers, discounts, and promotions. Be mindful of your budget and make responsible purchasing decisions to improve your credit over time.

Final Thoughts

Shopping from catalogues with bad credit can be a helpful tool for rebuilding your credit score and gaining access to essential products. By making on-time payments and being mindful of your spending, you can take steps towards improving your financial health. Remember to always read the fine print, compare options, and shop responsibly to make the most out of your shopping experience with a catalogue companion for bad credit.