A very poor credit score rating can be an obstacle in getting accredited for automobile finance. However, there are specialist lenders that work with individuals who struggle with poor credit. Finding the proper lender and getting the absolute best charges is crucial. For these looking to buy a automobile, there car loans available that are referred to as “bad credit automotive finance” or “poor credit score automotive finance“. This won’t affect your credit score score or leave a mark in your report.

Checking your credit score file can be a fantastic alternative to improve your credit rating by making certain that each one data held on you is correct and updated. For example, making certain that out-of-date financial associations don’t have a unfavorable influence in your credit score file. If you fall behind or cease making your funds, not solely might your car be repossessed but your credit score rating will start to drop. It’s because of this that you should fastidiously contemplate your month-to-month budget and only borrow what you can afford to pay again.

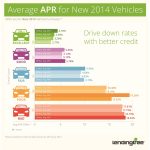

Often, taking a while to build your credit score score and get your funds in verify might pay off and be a worthwhile investment if you’ll be able to. By increase your credit score, you might be able to qualify for a decrease interest rate that would prevent hundreds in the lengthy term. However, many individuals are turning to automobile finance as a end result of their old automotive not being as a lot as scratch of this being their first car, which means they can’t wait to construct up their credit score document. Use our eligibility checker, then work out what you can afford using our easy automobile finance calculator. If you want to go ahead, you possibly can then complete a full software in minutes.

We can normally get you permitted for a car loan so long as you would possibly be keeping up along with your present debt levels, your credit score isn’t all the time a deciding issue. Once your whole car loan repayments have been made you will be the legal owner of the vehicle. We know the way easy it’s to turn into downcast when you’ve been refused automotive finance because of unfavorable credit ratings. If you have struggled to get accredited for automobile finance due to poor credit, having a black field fitted has two major benefits. One threat is having to many hard searches in your credit score file in a brief area of time, because this will make you appear desperate for finance. So the place possible, avoid making plenty of applications with a lot of firms in a brief period.

A soft search merely lets us see the way you at present manage your loans and repayments and the way you’ve managed your borrowing prior to now. We work with a panel of lenders so we will look to search out automobile finance choices for people with good credit score, bad credit, and somewhere-in-between credit score. So, even if you’ve been refused finance up to now or have a less than perfect credit score, we’d still be in a position to find the best automotive finance option for you. So, hopefully, we’ve proven you that credit score checks are nothing to be worried about. It is greater than attainable to examine your eligibility for car finance earlier than you might have a hard credit verify.

Is Gettington and Fingerhut the same?

Gettington and Fingerhut are both brands beneath the father or mother company, Bluestem Brands, Inc. They are completely different firms with similar codecs, and so they supply financing via WebBank. If you’ve one, you don't need the opposite as a outcome of they offer very similar objects.

You’ll then have the power to browse cars based mostly in your criteria and personal APR. Borrowing £7,500 at a consultant APR of 21.4%, annual rate of interest 21.36%, 47 monthly payments of £196.75 followed by 1 cost of £206.seventy five, total cost of credit score is £4,315, total quantity payable is £11,815. As automotive finance suppliers every have their very own criteria, all of them function in numerous ways.

Alternatively, you would have skilled a challenging life event, corresponding to taking a leave of absence from work, or losing your job. Should this occur, it’s probably that you’d fall behind together with your repayments. And as negative marks on your credit score file stay there for round six years, they could presumably be affecting your rating for a while. With over 15 years’ experience, we’ve helped 1000’s of shoppers discover bad credit finance and a automotive deal that works for them. A number of evaluations from customers who we have helped get car finance with poor credit. – if you’re proud of the APR and monthly repayments, we’ll allow you to with all of the admin, take care of the paperwork and negotiate with the supplier, to make certain you drive away with the proper automotive.

Is Wayfair now not with Comenity bank?

The Wayfair Credit Card Program, issued by Comenity Bank, has ended. Your Account is not valid for brand new transactions. However, rewards that you've earned through September 10, 2020 can be redeemed till September 10, 2021.

Now that your finance is in place, you’ll be assigned a devoted account supervisor that will provide you with one of the best quote we have for you. You’ll then know the way much you can borrow to remain within your budget when car searching. Impair Limited is an Appointed Representative of Carmoney Limited who’re authorised and controlled by the Financial Conduct Authority . Permitted actions include acting as a credit score dealer not a lender. The least expensive possibility to purchase a automobile is utilizing your own savings while private loans are usually the most cost effective way to borrow to purchase a automobile.